Trust Foundations: Dependable Solutions for Your Construction

Trust Foundations: Dependable Solutions for Your Construction

Blog Article

Enhance Your Heritage With Specialist Depend On Foundation Solutions

In the world of heritage preparation, the significance of developing a solid structure can not be overemphasized. Specialist count on foundation options provide a robust structure that can safeguard your assets and guarantee your wishes are executed exactly as meant. From decreasing tax obligation responsibilities to choosing a trustee who can effectively handle your affairs, there are crucial considerations that require focus. The complexities associated with depend on frameworks demand a calculated technique that lines up with your long-lasting objectives and worths (trust foundations). As we look into the subtleties of trust structure remedies, we uncover the crucial elements that can strengthen your legacy and supply a long-term impact for generations to find.

Advantages of Trust Foundation Solutions

Trust structure solutions use a robust framework for protecting possessions and making certain long-lasting monetary protection for people and companies alike. One of the primary advantages of count on structure services is possession protection.

In addition, count on structure services give a critical strategy to estate planning. Via counts on, people can outline how their properties need to be handled and distributed upon their passing away. This not just helps to avoid conflicts amongst beneficiaries however likewise guarantees that the individual's tradition is managed and handled successfully. Depends on likewise offer personal privacy advantages, as possessions held within a trust are exempt to probate, which is a public and typically prolonged lawful process.

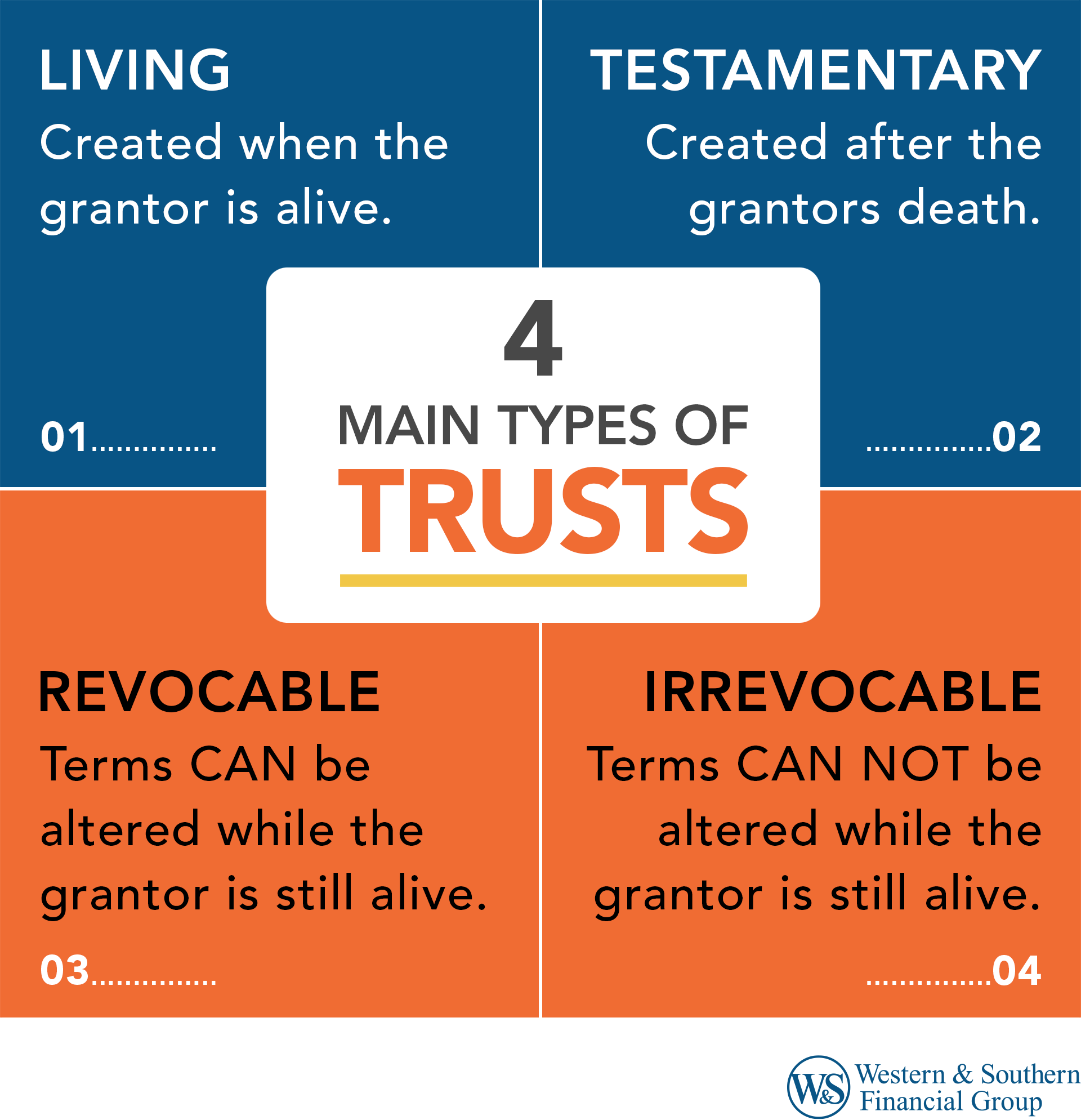

Sorts Of Trust Funds for Heritage Planning

When taking into consideration legacy planning, a vital aspect includes discovering different kinds of legal tools developed to maintain and distribute properties efficiently. One typical kind of depend on used in legacy planning is a revocable living depend on. This trust permits people to maintain control over their assets throughout their life time while making sure a smooth shift of these properties to recipients upon their passing away, staying clear of the probate process and providing privacy to the household.

Philanthropic trust funds are additionally popular for individuals looking to sustain a reason while keeping a stream of income for themselves or their recipients. Special requirements depends on are vital for individuals with handicaps to guarantee they receive needed care and assistance without threatening government benefits.

Recognizing the different sorts of depends on offered for heritage preparation is essential in creating a detailed strategy that straightens with private goals and top priorities.

Picking the Right Trustee

In the realm of heritage planning, a critical element that demands mindful factor to consider is the option of a proper individual to satisfy the critical role of trustee. Picking the right trustee is a choice that can considerably impact the successful execution of a trust fund and the fulfillment of the grantor's desires. When choosing a trustee, it is important to prioritize high qualities such as credibility, economic acumen, honesty, and a commitment to acting in the most effective rate of interests of the recipients.

Ideally, the other selected trustee must possess a solid understanding of economic matters, can making sound investment decisions, and have the capability to navigate complicated lawful and tax obligation demands. Moreover, reliable communication skills, interest to information, visit the site and a determination to act impartially are additionally vital features for a trustee to have. It is a good idea to choose a person who is trustworthy, responsible, and with the ability of fulfilling the duties and responsibilities related to the duty of trustee. By very carefully thinking about these aspects and choosing a trustee who straightens with the values and objectives of the count on, you can help guarantee the long-lasting success and preservation of your legacy.

Tax Ramifications and Advantages

Taking into consideration the monetary landscape surrounding trust structures and estate planning, it is vital to dive right into the intricate world of tax obligation effects and advantages - trust foundations. When establishing a trust, understanding the tax ramifications is essential for maximizing the advantages and minimizing prospective liabilities. Depends on provide different tax benefits depending upon their framework and purpose, such as minimizing estate taxes, income taxes, and gift tax obligations

One substantial advantage of specific depend on frameworks is the capacity to move possessions to beneficiaries with lowered tax repercussions. Unalterable depends on can remove assets from the grantor's estate, potentially lowering estate tax obligation. this article In addition, some depends on enable revenue to be distributed to beneficiaries, that may remain in lower tax obligation brackets, leading to general tax obligation savings for the household.

Nonetheless, it is necessary to keep in mind that tax laws are complex and conditional, emphasizing the requirement of consulting with tax obligation experts and estate planning specialists to make sure compliance and take full advantage of the tax benefits of depend on structures. Correctly browsing the tax obligation ramifications of counts on can cause significant savings and an extra reliable transfer of wide range to future generations.

Actions to Establishing a Depend On

The very first step in developing a trust fund is to clearly define the function of the trust fund and the properties that will certainly be consisted of. Next, it is critical to select the type of trust fund that finest straightens with your objectives, whether it be a revocable depend on, irreversible count on, or living trust.

Conclusion

Finally, establishing a depend on foundation can give various benefits for legacy planning, including possession security, control over distribution, and tax obligation advantages. By picking the suitable sort of trust fund and trustee, people can secure their assets and guarantee their dreams are accomplished according to their desires. Recognizing the tax obligation implications and taking the essential steps to develop a trust can help enhance your tradition for future generations.

Report this page